That’s it. That’s the post. Read more.

That’s it. That’s the post. Read more.

In the United States and much of the developed world today, most roads are publicly provided, i.e., they are built and operated by governments. This is not exclusively true, as many private toll roads exist, but the vast majority of roads are owned and operated by governments. Must it be this way?

A recent working paper by Alan Rosevear, Dan Bogart, and Leigh Shaw-Taylor looks at a very important case study: Britain in the 19th century. Britain is important because they were the leading economy in the world at the time, at the forefront of the Industrial Revolution. How were roads built and improved in England and Wales at this time? Here’s what the authors have to say in the abstract:

“non-profit organizations, known as turnpike trusts, built more new roads by attracting private investors and capable surveyors. We also show the Government Mail Road had the highest quality. Nevertheless, most turnpike trust roads were good quality, indicating their practical achievements.”

In the conclusion of the paper, they further add:

“Our analysis demonstrates that turnpike trusts were responsible for building 4,000 miles of new, good quality road in England and Wales, much of it between 1810 and 1838. On a directly comparable basis, the not-for-profit trusts built thirty times the mileage than had been built with direct Government funding during the early 1800s.”

To be clear, this paper is not a completely new discovery. It was already well-known that private companies built roads in Britain, as the authors make clear in their literature review. Similarly, there were many private turnpikes and toll roads in the US in the 19th century, as summarized in an encyclopedia entry by Klein and Majewski.

The Rosevear et al. paper adds new important details. First, they document the extent of private road building and improvements in the 19th century. Second, they show that these roads were generally of good quality, or at least they were of good quality for the time. Prior research had not documented these facts, thus making this a very important advance in our understanding of this time period. But perhaps more importantly, we see the possibility that many more roads today could be privately built and funded with user fee, especially considering that we are much, much wealthier today than 19th century Britain, we have more extensive and functional capital markets for raising the funds, etc.

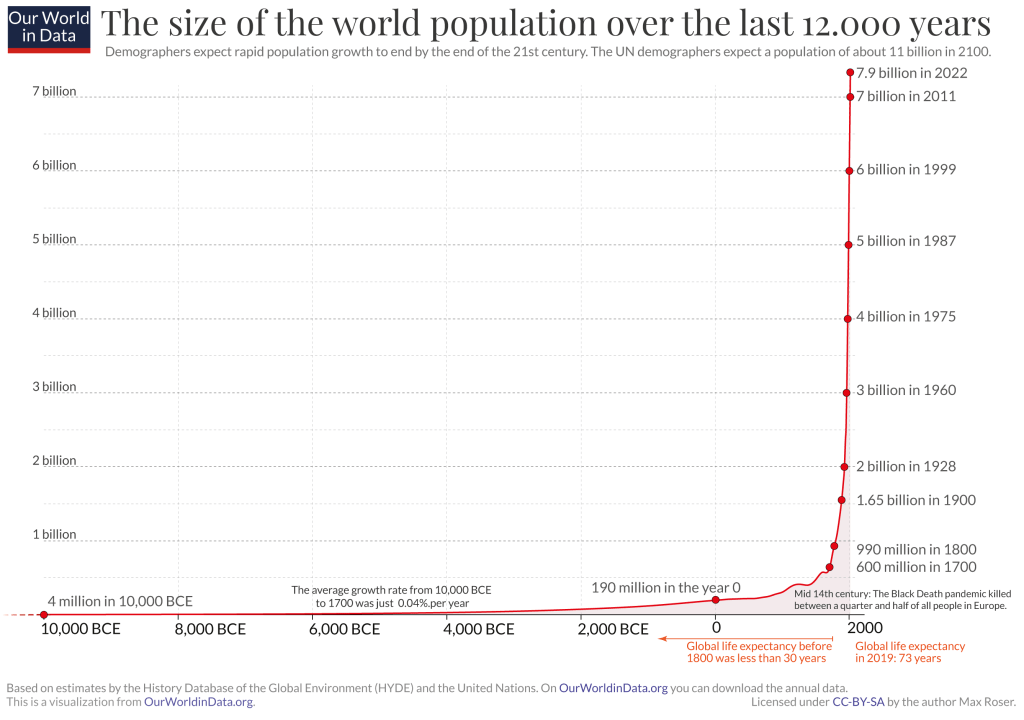

The all-cause mortality rate in 2021 for men in the US ages 18-39 was about 40% higher than the average of 2018 and 2019. That’s a huge increase, especially for a group that is not in the high-risk category for COVID-19. What’s causing it?

Some have suggested that heart disease deaths, perhaps induced by the COVID vaccines, is the cause. This is not just a fringe internet theory by anonymous Twitter accounts. The Surgeon General of Florida has said this is true.

What do the data say? The first thing we can look at is heart disease deaths for men ages 18-39.

The data I’m using is from the CDC WONDER database. This database aggregates data from US states, using a standardized system of reporting deaths. The most important thing to know is that in this database, each death can one have one underlying cause, and this is indicated on the death certificate. Deaths can also have multiple contributing causes (and most deaths do), and the database allows you to search for those too. But for this analysis, I’m only looking at the underlying cause.

Here’s the heart disease death data for men ages 18-39, presented two different ways. First the trailing 12-month average. Don’t focus too much on that dip at the end, since the most recent data is incomplete. Instead, notice three things. First, there was a clear increase in heart disease deaths. Second, that rise began in mid-2020, well before the introduction of vaccines. Third, once vaccines started being administered to this age group in Spring 2021, the number of deaths leveled off (though it didn’t return to pre-pandemic levels).

Here’s another way of looking at the data: 12-month time periods, rather than a trailing average. I created 12-month time periods starting in March and ending in February of the following year. I’ve also truncated the y-axis to show more detail, not to trick you. But don’t be tricked! The deaths are up 2-3%, not a more than doubling as the chart appears to show.

We can see in the chart above that the rise in heart disease deaths for young males completely preceded the vaccination period. Something changed, for sure, but the change wasn’t the introduction of vaccines. Heart disease deaths (by underlying cause) are only up 2-3%, while overall deaths are up around 40%.

So, to repeat the title question, what is killing these young men?

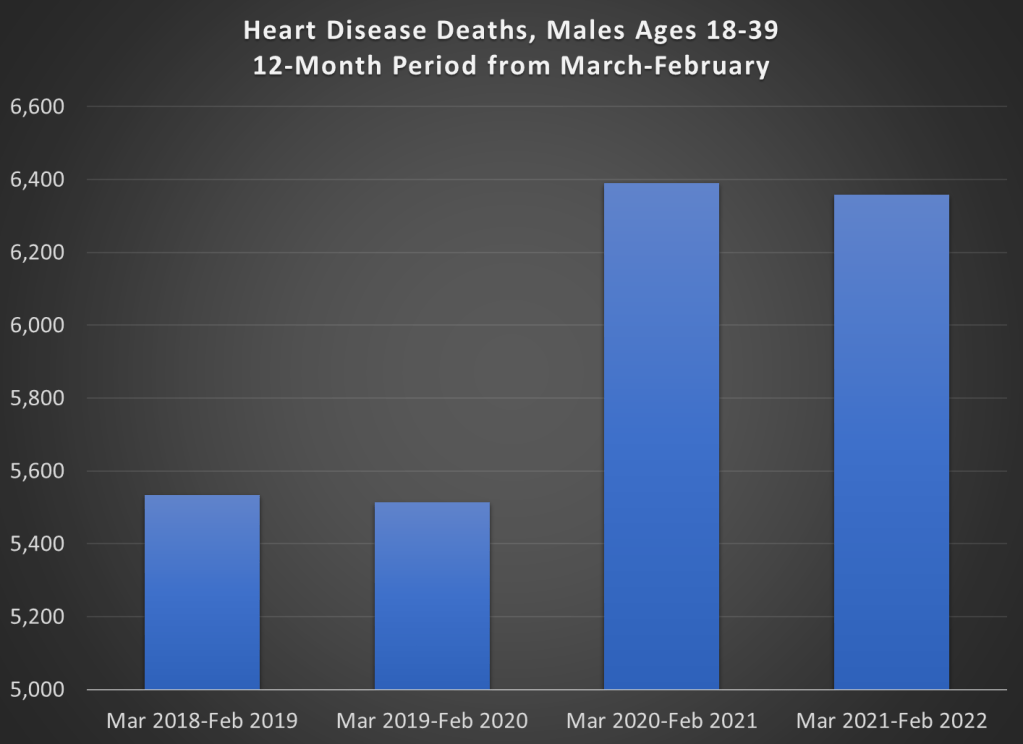

Continue readingLast night the major party candidates for Senate in Pennsylvania had their first and only debate. I didn’t watch it, since I don’t live in Pennsylvania. But judging by my Twitter feed, a lot of people did watch it, including (bizarrely to me) lots of people who don’t live in Pennsylvania. And overnight, tons of articles were written analyzing the debate, saying who “won” the debate, and so on (“5 Things You Need to Know About the Pennsylvania Senate Debate” etc.).

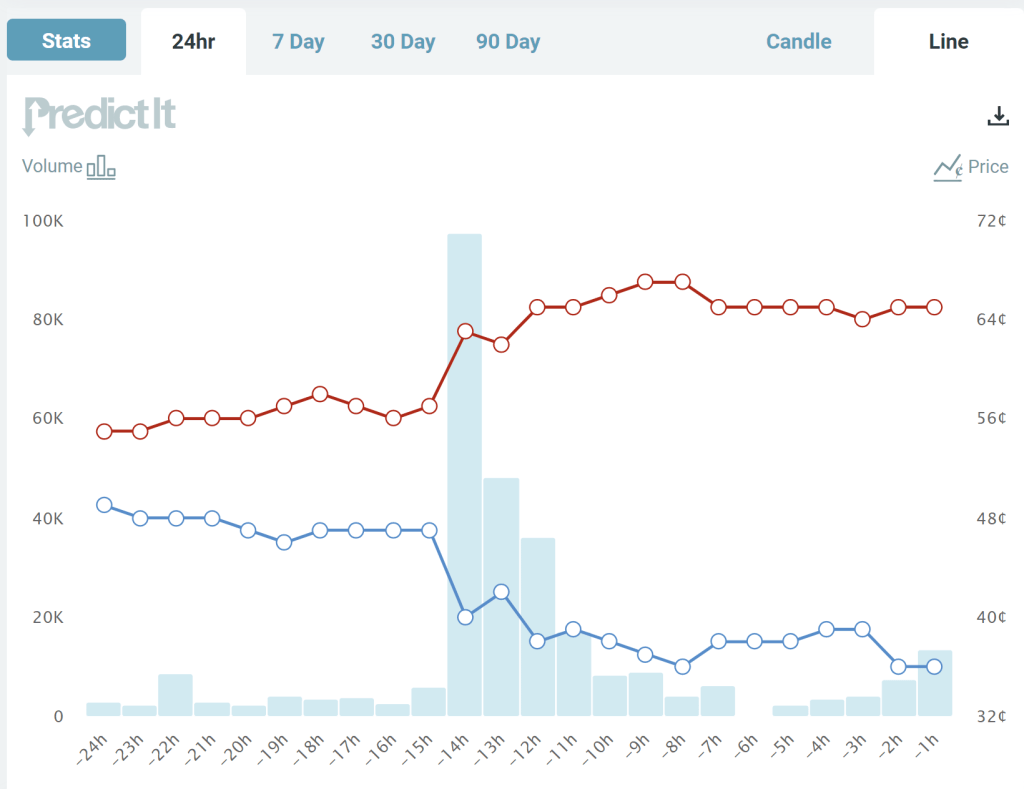

But this blog post is the only thing you need to read about that debate. And these charts are really all you need to look at.

These two charts come from the prediction market website PredictIt. The charts show the “odds” (more on that below) that each candidate will win the Pennsylvania Senate race, over a 90-day time horizon (first chart) and the last 24 hours (second chart). What do we see? The Democratic candidate has been leading for the entire race up until a week ago, though with his odds falling gradually over the past month or two.

Notice though the big jump last night during the debate. The Republican candidate moved up from odds of about 57% to odds of about 63%, close to where it stands as I write (67%). Based on this result, it’s safe to say that the Republican candidate “won” the debate, though not so decisively that the election is now a foregone conclusion. You don’t need to wait for the polls, which have consistently showed the Democratic candidate in the lead (though with the gap closing in recent weeks) — though of course, these betting odds could change as new polling data is released.

But where do these odds come from?

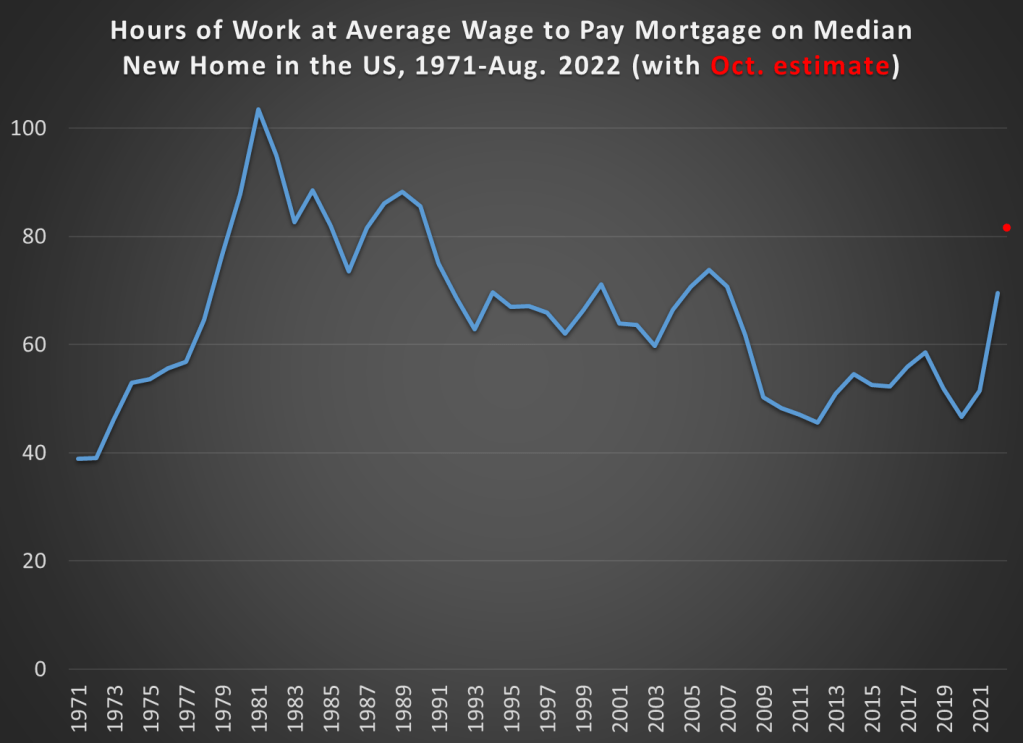

Continue readingMortgage interest rates are climbing quickly, while housing prices are still mostly high. These factors combined means that it is much more expensive to buy a home than in the recent past. But how much more expensive? And how does this compare with the past 50 years of history?

The chart below is my attempt to answer those questions. It shows the number of hours you would need to work at the average wage to make a mortgage payment (principal and interest) on the median new home in the US.

My goal here was to provide the most up-to-date estimate of this number consistent with the historical data. Thus, I had to use average wage data rather than median wage data, since the median hourly wage data is not available for 2022 yet. But as I’ve discussed before, while median and average wages are different, their rate of increase is roughly the same year-to-year, so it would show the same trends.

The final point plotted on the blue line in the chart is for August 2022, the last month for which we have median home price data, average wage data, and 30-year mortgage rates. Mortgage rates are the yearly average (or monthly average in the case of August 2022).

You’ll also notice a red dot at the very end of the series. This is my guess of where the line will be in October 2022, once we have complete data for these three variables (right now only mortgage rates are available in October for the three series I am using). I’m doing my best here to provide as much of a real-time picture as possible, given that rates are rising very sharply right now, while still providing consistent historical comparisons. If that estimate is roughly correct, mortgage costs on new homes are now less affordable than any year since 1990.

What do you notice in the chart?

Continue readingThe Mont Pelerin Society was founded 75 years ago. The title of this post was the opening sentence of the Statement of Aims the new Society agreed upon. They had many concerns about what they considered “central values,” but primary among those concerns were the dangers related to market economies: “a decline of belief in private property and the competitive market” and “the growth of theories which question the desirability of the rule of law.”

How has the world done since 1947? It’s easy to point to the decline of communism and socialism, both in practice and as a dominant theory, as a victory for the goals of the Mont Pelerin Society. However, we might be concerned that in the non-communist world, economic freedom has declined even as communism has failed. Let’s dig a little deeper.

One source we can use is an extension of the Fraser Institute’s Economic Freedom of the World index. The primary index only extends back to 1970, but recently Lawson and Murphy have constructed a version of the index which goes all the way back to 1950 for some countries. As far as I’m aware, they haven’t yet perfectly mapped the pre-1970 index with the primary index that extends to the present, but I’ll make a quick comparison using the available data. The 1950 data brings us very close to the date of the first MPS meeting.

Here’s a list of countries relevant to the discussion at MPS in 1947. The list includes countries where attendees came from, as well as other countries of interest to the discussion, such as China and Russia (I’m using the list from Caldwell’s recent edited transcripts of the 1947 meeting). Caveat: this isn’t a chain-linked index, so the 1950 and 2020 numbers are perfectly comparable. Also, the 2020 number only includes Areas 1-4 of the index, since that’s what the pre-1970 data contains.

The table above should give us some optimism about the state of market economies in the world from the perspective of 1947. Not only have China and Russia, clearly improved their economic freedom scores, but all of the Western market economies have as well. Again, exercise caution in interpreting these, since it’s not a chain-linked index, and it excludes one area of economic freedom (regulation, which surely has grown substantially since 1947). Despite those cautions, the picture in 2020 looks pretty good compared with 1950.

But what of other liberal institutions? While the MPS statement of aims doesn’t specifically mention democratic institutions, the threat to democracy seems to clearly be a concern in 1947 (“extensions of arbitrary power” and “freedom of thought and expression”).

Continue readingI have previously wrote about living standards in Ireland, and how GDP per capita overstates typical incomes because of a lot of foreign investment.

This is not to say that foreign investment is bad — to the contrary! But standard income statistics, such as GDP, aren’t particularly useful for a country like Ireland.

Norway has a similar challenge with national income statistics, but a different reason: Oil. Norway has a very large supply of oil revenues relative to the size of the rest of its economy, and oil revenues are counted in GDP. But those oil revenues don’t necessarily translate into higher household income or consumption.

Using World Bank data, Norway appears to be very rich: GDP per capita in nominal terms was about $90,000 in 2021. Compare that with $70,000 in the US, which is a very rich country itself. Sounds extremely wealthy!

Of course, by that same statistic, average income in Ireland is $100,000. But after making all the proper adjustments, as we saw in my prior post, Ireland is right around the EU average in terms of what individuals and households actually consume.

What if we make similar adjustments for Norway?

Continue readingLast week I wrote about wealth growth during the pandemic, but my favorite way to look at wealth data is comparing different generations. Last September I wrote a post comparing Boomers, Gen Xers, and Millennials in wealth per capita at roughly the same age. At the time, Millennials were basically equal to Gen X at the same age, and we were a year short of having comparable data with Boomers.

What does it look like if we update the chart through the second quarter of this year?

I won’t explain all of the data in detail — for that see my post from last September. I’ll just note a few changes. We now have single-year population estimates for 2020 and 2021, so I’ve updated those to the most recent Census estimates for each cohort. Inflation adjustments are to June 2022, to match the end of the most recent quarter of data from the Fed DFA. We still have to use average wealth rather than median wealth for now, but the Fed SCF is currently in progress so at some point we’ll have 2022 median data (most recent currently is 2019, and there’s been a lot of wealth growth since then).

What do we notice in the chart? First, we now have one year of overlap between Boomers and Millennials. And it turns out… they are pretty much at the same level per capita! Millennials have also now fallen slightly behind Gen X at the same time, since they’ve had no wealth growth (in real, per capita terms) since the end of 2021 to the present.

But Millennials have fared much better in 2022 with the massive drop in wealth: about $6.6 trillion in total wealth in the US was lost (in nominal terms) from the first to the second quarter of 2022. None of that wealth loss was among Millennials, instead it was roughly evenly shared among the three older generations (Boomers hid hardest). This difference is largely because Millennials hold more assets in real estate (which went up) than in equities (which went way down). The other generations have much more exposure to the stock market at this point in their life.

You can clearly see that affect of the 2022 wealth decline if you look at the end of the line for Gen X. You can’t see the effect on Boomers, since I cut off the chart after the last Gen X comparable data, but they saw a big decline since 2021 as well: about 6% per capita, along with 7% for Gen X. Even so, Gen X is still about 18% wealthier on average than Boomers were at the same age.

Of course, even since the end of the second quarter of 2022, we’ve seen further declines in the stock market, with the S&P 500 down about 4%. And who knows what the next few months and quarters will bring. But as of right now, Millennials don’t seem to be doing much worse than their counterparts in other generations at the same age.

In the US wealth distribution, which group has seen the largest increase in wealth during the pandemic? A recent working paper by Blanchet, Saez, and Zucman attempts to answer that question with very up-to-date data, which they also regularly update at RealTimeInequality.org. As they say on TV, the answer may shock you: it’s the bottom 50%. At least if we are looking at the change in percentage terms, the bottom 50% are clearly the winners of the wealth race during the pandemic.

Average wealth of the bottom 50% increased by over 200 percent since January 2020, while for the entire distribution it was only 20 percent, with all the other groups somewhere between 15% and 20%. That result is jaw-dropping on its own. Of course, it needs some context.

Part of what’s going on here is that average wealth at the bottom was only about $4,000 pre-pandemic (inflation adjusted), while today it’s somewhere around $12,000. In percentage terms, that’s a huge increase. In dollar terms? Not so much. Contrast this with the Top 0.01%. In percentage terms, their growth was the lowest among these slices of the distribution: only 15.8%. But that amounts to an additional $64 million of wealth per adult in the Top 0.01%. Keeping percentage changes and level changes separate in your mind is always useful.

Still, I think it’s useful to drill down into the wealth gains of the bottom 50% to see where all this new wealth is coming from. In total, there was about $2 trillion of nominal wealth gains for the bottom 50% from the first quarter of 2020 to the first quarter of 2022. Where did it come from?

Continue readingFrom the recent CPI inflation report, one of the biggest challenges for most households is the continuing increase in the price of food, especially “food at home” or what we usually call groceries. Prices of Groceries are up 13.5% in the past 12 months, an eye-popping number that we haven’t seen since briefly in 1979 was only clearly worse in 1973-74. Grocery prices are now over 20% greater than at the beginning of the pandemic in 2020. Any relief consumers feel at the pump from lower gas prices is being offset in other areas, notably grocery inflation.

The very steep recent increase in grocery prices is especially challenging for consumers because, not only are they basic necessities, if we look over the past 10 years we clearly see that consumer had gotten used to stable grocery prices.

The chart above shows the CPI component for groceries. Notice that from January 2015 to January 2020, there was no increase in grocery prices on average. Even going back to January 2012, the increase over the following 8 years was minimal. Keep in mind these nominal prices. I haven’t made any adjustment for wages or income! (If you know me, you know that’s coming next.) Almost a decade of flat grocery prices, and then boom!, double digit inflation.

But what if we compare grocery prices to wages? That trend becomes even more stark. I use the average wage for non-supervisory workers, as well as an annual grocery cost from the Consumer Expenditure Survey (for the middle quintile of income), to estimate how many hours a typical worker would need to work to purchase a family’s annual groceries. (I’ve truncated the y-axis to show more detail, not to trick you: it doesn’t start at zero.)